|

What is distance selling?

European Union (EU) Marketplace rules effective July 1, 2021 require that any seller with more than €10,000 (euro) worth of distance sale of goods must register with their local tax authorities and charge the Value Added Tax (VAT) rate of the buyer’s country. Selling to EU countries beyond the EUR threshold requires registering for either One-Stop-Shop (OSS) or in each individual EU member state where you sell on BrickLink. This excludes sales to your home country. You may enable distance selling on BrickLink after you obtain your OSS ID number or the VAT IDs for the countries in which you conduct business. Does BrickLink check for distance selling? Our system checks the €10,000 threshold monthly. Sellers who reach the threshold are notified by email. Those sellers have 30 days to register and enable One-Stop-Shop (OSS) or VAT IDs. If a seller does not enable OSS or VAT IDs, then EU distance selling will be blocked for the rest of that calendar year and the following full year. However, distance selling can be reinstated at any time after being blocked if the seller successfully completes the registration process. How do I enable distance selling? Visit the VAT section on the Store Settings Management page. In the Distance Selling subsection there are two options.

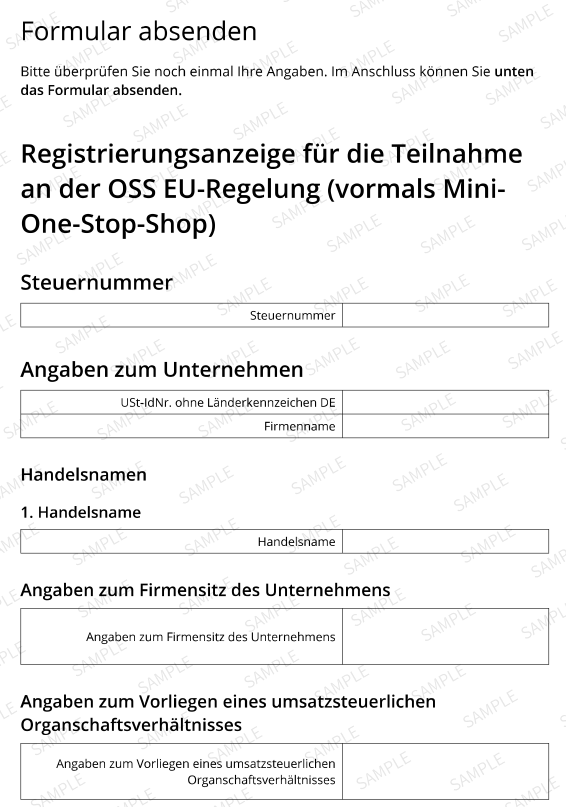

Once submitted, the admin team will review your documents and confirm or deny OSS distance selling. In some instances, resubmission may be necessary in which case an admin will reach out with more details. Below are a few examples of official OSS documents. Please note that your document may look slightly different.

What if I pass the threshold in the future? Our system checks this threshold monthly and will send instructions if you pass the EUR 10,000 threshold in the future. What if my threshold is almost at EUR 10,000? We will send an official email when you pass the threshold. However, you can get a head start by registering for either One Stop Shop (OSS) or in each individual EU Member State where you sell on BrickLink. Once you obtain your OSS ID number or the VAT IDs for the countries you transact in, you can then enable distance selling on BrickLink. To enable distance selling, go to the Value Added Tax (VAT) section on the Store Settings page. |