|

Jump to: BrickLink collecting sales tax:

US sales tax settings Tax exemptions Orders New fields in order received Refunds New fields in quote received Buyer to seller upgrade Optional Sales tax settings for all other states: |

BrickLink collecting US sales tax |

| Due to recent Marketplace Facilitator legislation, many states have started requiring that marketplace facilitators such as BrickLink collect sales tax directly from buyers. We will collect the tax directly from the buyer at the time the order is paid and remit it to the correct tax authority. We are partnering with a third party that specializes in sales tax and they will calculate the correct amount of tax for every order based on the “Ship To” address of the order. Currently, there are four Gear categories (pens, school supplies, backpacks & lunchboxes, and clothing) that may have different tax rates depending on the state and the time of year. For most states, tax is charged on the full order amount, which includes shipping and all other fees. |

| Store requirements |

|

| US sales tax settings |

|

In states that BrickLink begins collecting sales tax, BrickLink will collect sales tax on all orders shipped to those states, and the self-collecting sales tax feature for sellers will be disabled. If a seller has previously enabled sales tax in states where BrickLink will now collect sales tax, the state(s) will be removed from the settings. BrickLink now collects sales tax for most US states. For a complete schedule of when BrickLink started collecting tax in each state, please check here: Helpful link:

List of states where we collect sales tax  Back to Top |

| Tax exemptions |

|

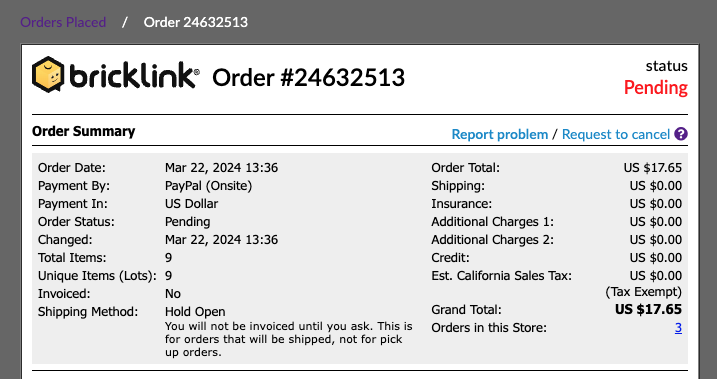

Resellers with a sales tax permit, who can provide a valid resale certificate may be exempted from sales tax when product is purchased for resale. If you have a reseller certificate, please send it to our help desk and wait for a confirmation from our advisors. After your reseller status is verified, you will see a checkbox at checkout that will allow you to remove sales tax for each eligible order. Tax exemption requirements are different for each state, so please check with corresponding state revenue departments to determine the solution that works best for you. If a certificate has an expiration date, sales tax will be applied automatically for orders placed after the expiration date. Please make sure that you provide new certificates at least 2 weeks before the expiration date of the previous one. In most states a resellers permit/ license cannot be used as a resellers tax exemption certificate. Please be sure you are sending a Tax Exemption Certificate from the state you are registered in.  Back to Top |

| Orders |

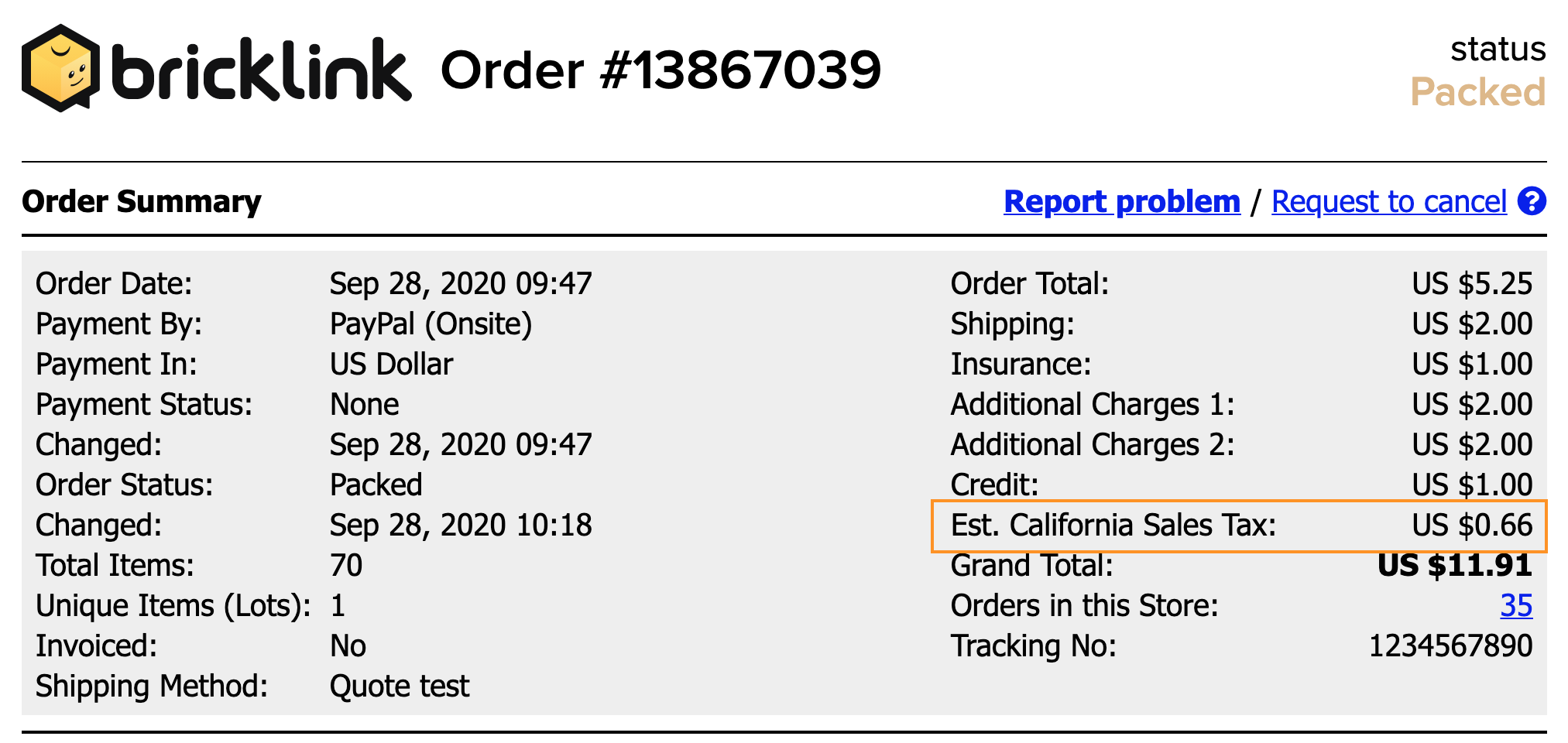

On the order detail page there will be a line in the upper section where US sales tax is shown. Tax amounts will be shown several other places as well, including on the invoice when using the default invoice template. When using a customized template, the seller is responsible to ensure that the correct of amount of sales tax is shown. In cases of tax exempt orders, order detail page would have state tax value at $0.00.  Back to Top |

| New fields in order received |

|

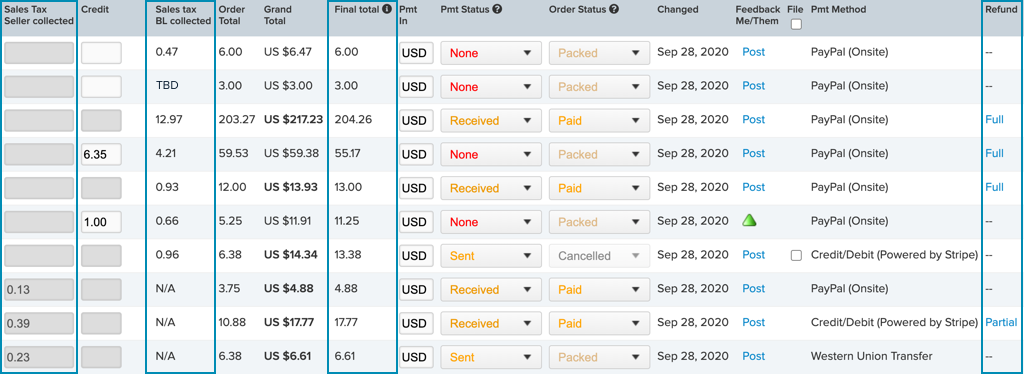

Sales tax - seller collected For US sellers, the “Tax” field name has been changed to “Sales Tax Seller collected” to distinguish it from the new system-collected sales tax. This field will be disabled for orders where BrickLink collects sales tax. Sales tax - BrickLink collected A new “Sales tax BL collected” field has been introduced. The seller has no control over this field.

Final total This is a new field. It is calculated by subtracting Sales tax BL collected from the Grand total. Refunds A refund field has been introduced. When a refund is issued for an order, the field will indicate if the refund was a full refund or partial refund. The link will take you to the Manage Refund page.  Back to Top |

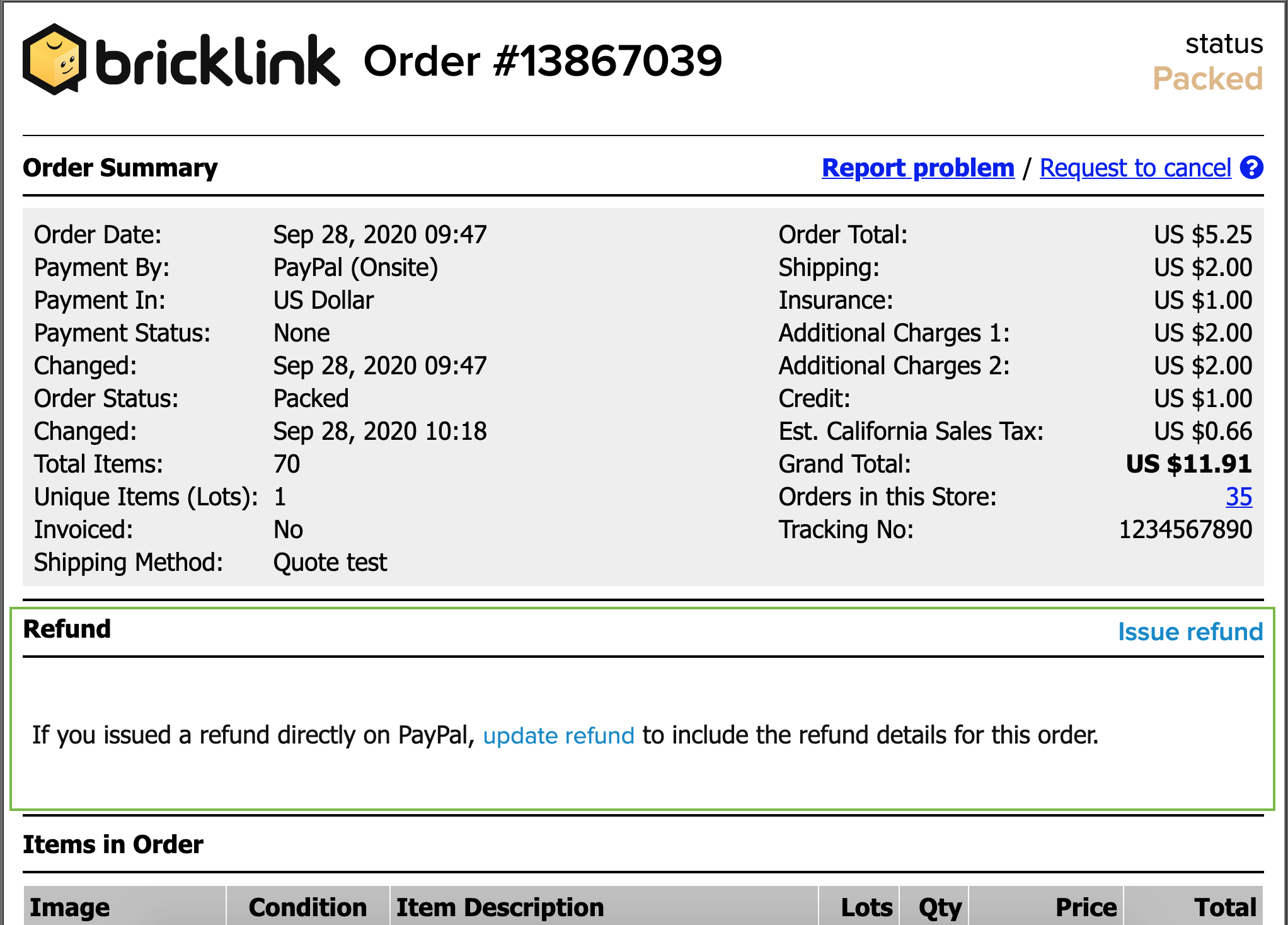

| Refunds |

We recommend that sellers use BrickLink’s refund system to issue refunds. For orders where BrickLink has collected sales tax, our refund system will calculate the amount refunded by the seller and the sales tax refunded by BrickLink on a “percentage-of-order” basis. Back to Top |

| New fields in quotes received |

|

Sales tax - seller collected For US sellers, the “Tax” field name has changed to “Sales Tax Seller collected” to distinguish from system-collected sales tax. This field will be disabled for orders where BrickLink collects sales tax. Sales tax - BrickLink collected New “Sales tax BL collected” field is introduced. Sellers have no control over this field.

Final total This is a new field. It is calculated by subtracting Sales tax BL collected from the Grand total.  Back to Top |

| Buyer to seller upgrades |

When upgrading to seller, the Store address entered will become the store / business address.  Back to Top |

Optional US sales tax settings for all other states |

| The sales tax setting for sellers located in the US is located on the Store Management page. This setting is optional and BrickLink does not investigate whether sellers should be charging sales tax to their buyers. |

| General Information |

|

| Sales Tax Calculation |

|

You can enter a tax rate between 0-25%.

|

| Checkout |

Back to Top |